What's Included in SaaS

Cost of Revenue (COGS)?

Adam Tzagournis, CPA · 7 min read

Adam Tzagournis, CPA · 7 min read

For SaaS companies, one key expense to watch is your cost of revenue (COGS). This figure determines how profitable each customer is to you. In turn, this impacts your valuation (and investor interest). So, how do you show it correctly in both your historical results and growth projections? In this blog post, we’ll give a few quick examples that simplify the matter (trust us, it can get complex very quickly!).

But what exactly should be included in cost of revenue?

Simply put, SaaS COGS are the direct costs to provide your software to customers. You can think of them as the costs to deliver your product.

For your SaaS company, that includes costs such as:

- software license fees

- application hosting and support costs

- website development and support costs

- customer support and account management costs

- data communication expenses

Exclude the following since they’re part of operating expenses:

- marketing

- sales

- general and administrative (G&A) expenses

Proceed with caution though. Although direct costs are the rule, there are plenty of exceptions.

Apples-to-apples: public SaaS companies

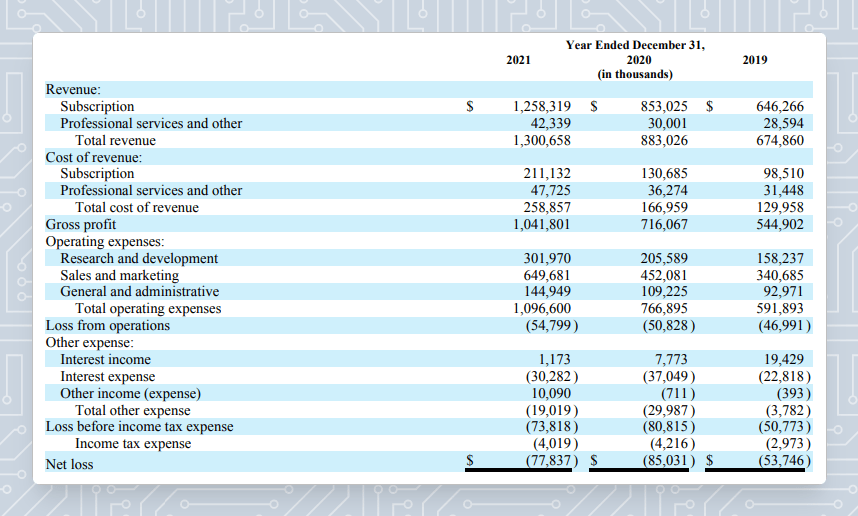

Your board and investors want to compare your company’s performance to other SaaS companies. To do that, your SaaS COGS categorization on the P&L must match how others do it. Let’s take a look at a few:

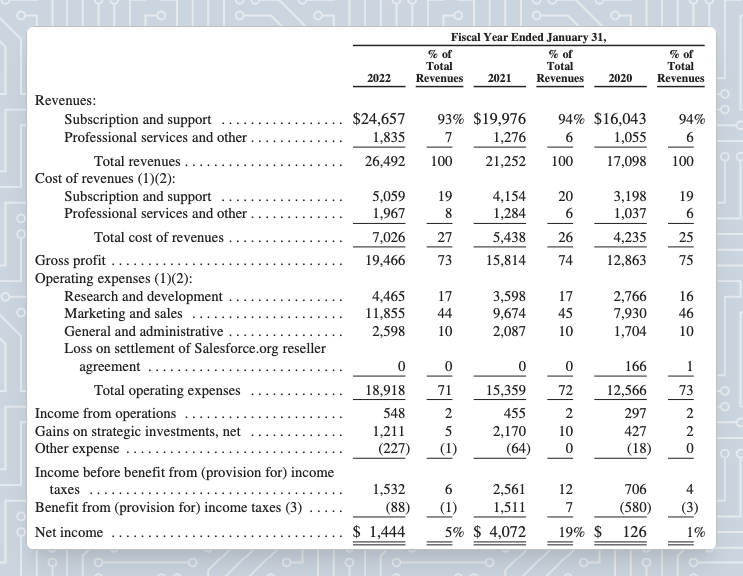

Salesforce

Salesforce’s 10-K explains their allocation to cost of revenue:

Cost of subscription and support revenues primarily consists of expenses related to delivering our service and providing support, including the costs of data center capacity, certain fees paid to various third parties for the use of their technology, services and data, employee-related costs such as salaries and benefits, and allocated overhead.

Our cost of subscription and support revenues also includes amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company’s research and development efforts. Also included in the cost of subscription and support revenues are expenses incurred supporting the free user base of Slack, including third-party hosting costs and employee-related costs specific to customer experience and technical operations.

Cost of professional services and other revenues consists primarily of employee-related costs associated with these services, including stock-based expense, the cost of subcontractors, certain third-party fees and allocated overhead. We expect the cost of professional services to be approximately in line with revenues from professional services in future fiscal periods. We believe that this investment in professional services facilitates the adoption of our service offerings, helps us to secure larger subscription revenue contracts and supports our customers’ success.

Something catch your eye? Note how they separate cost of revenue into 2 line items. This step is crucial because it allows them to show 2 separate gross margins. That way, they’ll get credit for higher gross margins on their software. Similarly, investors can see their margins on professional services are close to 0. Salesforce even explains why they’re ok with this: it’s part of their strategy to ensure customer success.

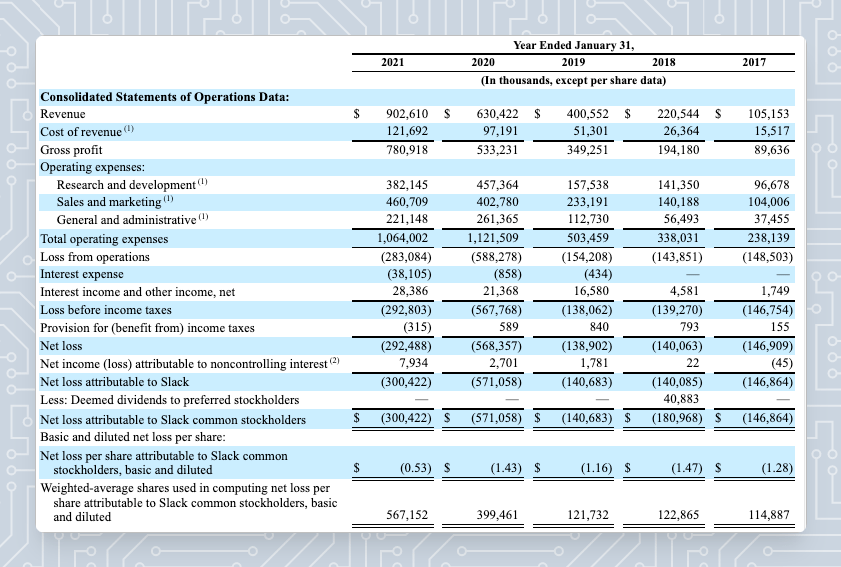

Slack

From Slack’s 10-K:

Cost of revenue consists primarily of expenses related to hosting Slack and providing ongoing customer support for paid customers. These expenses include employee compensation (including stock-based compensation) and other employee-related expenses for customer experience, professional services, and technical operations staff, payments to outside service providers, third-party hosting costs, payment processing fees, and amortization expense associated with internally-developed and purchased technology. We expect our cost of revenue to continue to increase in absolute dollar amounts as we grow our business and revenue.

Here, Slack includes payment processing fees (i.e. credit card fees), and even stock-based compensation. The latter can get messy, so talk to your auditors about how to classify them.

HubSpot

From HubSpot’s 2022 form 10-K:

Cost of subscription revenue consists primarily of managed hosting providers and other third-party service providers, employee-related costs including payroll, benefits and stock-based compensation expense for our customer support team, amortization of capitalized software development costs and acquired technology, and allocated overhead costs, which we define as rent, facilities, depreciation of fixed assets, and costs related to information technology.

Cost of professional services and other revenue consists primarily of personnel costs of our professional services organization, including salaries, benefits, bonuses and stock-based compensation, amortization of capitalized software development costs associated with our internally built software platform, as well as professional fees and allocated overhead costs.

We expect that the cost of subscription and professional services and other revenue will increase in absolute dollars as we continue to invest in growing our business. We expect stock-based compensation to increase on an absolute dollar value basis due to anticipated headcount growth, continued investment in stock-based awards, and a shift in stock award vesting schedules from four years to three years beginning in 2022. Over time, we expect to gain benefits of scale associated with our costs of hosting our CRM Platform relative to subscription revenues, resulting in improved subscription gross margin, exclusive of stock-based compensation. We expect professional services and other margins to range from a moderate loss to breakeven for the foreseeable future, exclusive of stock-based compensation.

Like Salesforce, HubSpot splits out software cost of revenue from professional services. Again, they also explain they won’t profit from professional services.

The common thread

Ok, there are a few trends here worth pointing out. First, all 3 companies include expenses like hosting costs and 3rd party tech needed for their product. Second, they include payroll costs specific to customer experience and technical operations. Third, they allocate overhead for these employees. The proper allocation of salaries and overhead costs is hard to get right, and best left to a separate post entirely.

Bonus: gross margin insight

For gross margins, a good rule of thumb is that SaaS companies should be close to 80% for their SaaS product. Why is this important? Because gross margin isn’t just an isolated metric. On the contrary, it dictates your customer lifetime value (CLTV), which impacts your company valuation.

Conclusion

To sum up, it can be tricky to determine the cost of revenue for your SaaS business. The goal is to get an accurate picture of the true cost of providing your product to customers. Fortunately, public SaaS companies have thought long and hard about this (and have the approval from their expensive auditors too!). When in doubt, follow their lead. Also, don’t forget the 80/20 rule for classifying expenses. If they’re not material, don’t fret too much. It’s possible your auditor won’t care either. Remember, perfection is the enemy of good.

Don’t want to think about allocations at all? Our financial model software for SaaS companies does it for you automatically. You can start for free too (yes, even the onboarding)!